If you’re an independent software vendor (ISV) who sells payment applications to retailers, what does it mean when your payment application meets PCI standards, but doesn’t actually protect your customers? A lot of people out there, especially consumers, wouldn’t even think the security of the software that handles their credit card data is an issue. Many people don’t realize that there’s a huge problem with data security in point-of-sale (POS) and retail software applications. However, time and time again we see major data breaches occurring through cash register systems that process credit card data, which invariably means that those systems aren’t adequately protecting consumer data.

If you’re an independent software vendor (ISV) who sells payment applications to retailers, what does it mean when your payment application meets PCI standards, but doesn’t actually protect your customers? A lot of people out there, especially consumers, wouldn’t even think the security of the software that handles their credit card data is an issue. Many people don’t realize that there’s a huge problem with data security in point-of-sale (POS) and retail software applications. However, time and time again we see major data breaches occurring through cash register systems that process credit card data, which invariably means that those systems aren’t adequately protecting consumer data.

The problem with data security in payment applications arises when retail ISVs and POS vendors certify their payment applications with the Payment Card Industry Security Standards Council (PCI-SSC). The PCI-SSC requires that these businesses use strong encryption and encryption key management in their payment applications. Although most payment application vendors incorporate encryption and encryption key management into their solutions, many of them do it poorly, skating by with the minimum requirements. In the end, their applications pass certifications but would not protect their customers--or themselves--in the event of a data breach.

And data breaches are happening every day! Today data breaches are considered a matter of “when,” not “if.” It is almost a certainty that it is only a matter of time before a data breach affects one of your customers.

Unfortunately, encryption and encryption key management are complicated tools for ISVs to build on their own--in fact, doing a “home grown” encryption project is almost never recommended by encryption experts. Because many ISVs don’t have the resources to create their own encryption and encryption key management, Townsend Security offers an encryption key management solution that retail ISVs and POS vendors can integrate into their applications to provide their customers with industry standard, certified data security solutions.

We recently published an eBook titled, “Overcoming Critical Security Issues - a Guide to Proper Encryption Key Management,” for POS vendors and Retail ISVs. Read an excerpt written by Townsend Security Founder and CEO Patrick Townsend and download the eBook now:

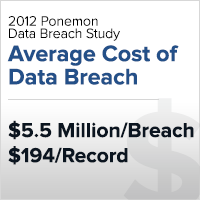

“Merchants are very worried about data breaches and the potential effect of a breach on their business. The average data breach costs a company $5.5 million, which includes the cost of fines as well as the costs associated with lost business, litigation, and brand damage. A successful exploit of poor data security can destroy years of work building brand reputation. Smaller businesses may never fully recover from a well-publicized data breach. Payment application vendors with poor encryption and key management are subjecting not only their customers to these risks, but themselves as well.”

“Merchants are very worried about data breaches and the potential effect of a breach on their business. The average data breach costs a company $5.5 million, which includes the cost of fines as well as the costs associated with lost business, litigation, and brand damage. A successful exploit of poor data security can destroy years of work building brand reputation. Smaller businesses may never fully recover from a well-publicized data breach. Payment application vendors with poor encryption and key management are subjecting not only their customers to these risks, but themselves as well.”

Good encryption and key management for credit card numbers will also give payment application vendors an advantage over their competitors. PCI standards are not set in stone; data security is constantly evolving to meet new challenges and threats. CEOs and Product Managers in the payment application industry should be having a high-level discussion about data security. Now is the time to move to a second generation data security strategy for protecting customer credit card information. You need a solution that doesn’t just look good on paper, but will protect you and your customers in the event of a breach.”

To read more, download the eBook now.