Two Factor Authentication (2FA) and a look at the compliance regulations that require identity verification for remote access.

The use of two factor authentication provides an added layer of security beyond just a username and password. Because passwords can be guessed, stolen, hacked, or given away, they are a weak layer of security if used alone. Since frequent access happens from outside of the network, remote login is considered high-risk and requires additional steps to confirm user identity. Protecting access with two factor authentication adds identity assurance and significantly reduces risk of unauthorized access in the retail, healthcare, and financial industries.

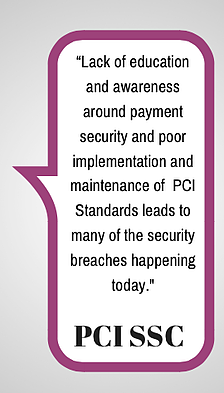

Payment Card Industry Data Security Standards (PCI DSS)

The PCI Security Standards Council has stated that they will continue to change and evolve compliance regulations over time as attacks change. In PCI DSS section 8.3 the requirement states that organizations must “incorporate two factor authentication for remote access (network-level access originating from outside the network) to the network by employees, administrators, and third parties.” The objective of this requirement is to ensure that merchants implement strong access control measures so that authorized individuals with network and computer access can be identified, monitored, and traced.

Requirement 8: Assign a unique ID to each person with computer access. Assigning a unique identification (ID) to each person with access ensures that each individual is uniquely accountable for his or her actions. When such accountability is in place, actions taken on critical data and systems are performed by, and can be traced to, known and authorized users.

Note: These requirements are applicable for all accounts, including point-of-sale accounts, with administrative capabilities and all accounts used to view or access cardholder data or to access systems with cardholder data.

Requirement 8.3: Incorporate two factor authentication for remote access (network-level access originating from outside the network) to the network by employees, administrators, and third parties.

Note: Two factor authentication requires that two of the three authentication methods (something you know - something you have - something you are) be used for authentication. Using one factor twice (for example, using two separate passwords) is not considered two factor authentication.

Health Insurance Portability and Accountability Act (HIPAA) and the Health Information Technology for Economic and Clinical Health (HITECH) Act

HIPAA was an act signed in 1996 by President Bill Clinton, meant to improve the efficiency of the healthcare system by encouraging the use of Electronic Data Interchange (EDI) when accessing Protected Health Information (PHI). Covered entities must develop and implement policies and procedures for authorizing PHI access in accordance with the HIPAA Security Rule Administrative Safeguards 164.308(a)(4) [Information Access Management: Access Authorization] and Technical Safeguards 164.312(d) [Person or Entity Authentication] and the HIPAA Privacy Rule at §164.508 [Uses and disclosures for which an authorization is required].

The HIPAA Security Rule requirements have most recently been expanded via the HITECH Act, which establishes mandatory federal security breach reporting requirements with expanded criminal and civil penalties for non-compliance. To remain HIPAA compliant and avoid fines for HITECH Act non-compliance, strict control over access to patient records must be demonstrated.

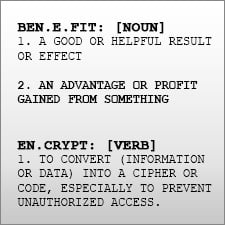

HIPAA/HITECH requirements regarding the transmission of health-related information include adequate encryption [164.312(e)(2)(ii) when appropriate, and 164.312(a)(2)(iv)], authentication [164.312(d)] or unique user identification [164.312(a)(2)(i)] of communication partners. By selecting Two Factor Authentication (2FA), users would be required to combine something they know, something they have, or something they are; thereby providing more secure access to PHI files. Protected Health Information can be account numbers, medical record numbers and geographic indicators among other private consumer information. It is important that only those health care workforce members who have been trained and have proper authorization are granted access to PHI.

Gramm-Leach-Bliley Act (GLBA) & Federal Financial Institutions Examination Council (FFIEC)

The Federal Financial Institutions Examination Council (FFIEC) is charged with providing specific guidelines for evaluating financial institutions for GLBA (Gramm-Leach-Bliley Act) regulations compliance. The FFIEC also provides guidance around the use of two factor authentication to strengthen systems in the financial industry and strengthen banking websites against financial fraud with the document, “Authentication in an Internet Banking Environment” (v.3). For banks offering internet-based financial services, the guidance document describes enhanced authentication methods that regulators expect banks to use when authenticating the identity of customers using online products and services, as follows:

- Financial institutions offering internet-based products and services to their customers should use effective methods to authenticate the identity of customers using those products and services. Furthermore, the FFIEC considers single-factor authentication (as the only control mechanism) to be inadequate for high-risk transactions involving access to customer information or the movement of funds to other parties.

- The implementation of appropriate authentication methodologies should start with an assessment of the risk posed by the institutions’ Internet banking systems. The authentication techniques employed by the financial institution should be appropriate to the risks associated with those products and services.

- Account fraud and identity theft are frequently the result of single-factor (e.g. ID/password) authentication exploitation.

- Where risk assessments indicate that the use of single factor authentication is inadequate, financial institutions should implement multi-factor authentication, layered security, or other controls reasonably calculated to mitigate those risks.

The FFIEC is a government agency which works with many other government agencies to unify how financial institutions should be supervised. The guideline documents recommend banks treat the FFIEC as baseline compliance for safe online authentication and transaction verification. Since all single factor authentication techniques can be easily compromised, financial institutions should not rely solely on any single control for authorizing high risk transactions, but rather institute a system of layered security with multi-factor authentication.

Although there are varying levels of enforcement, guidelines vs. laws vs. fines, it is clear that two factor authentication plays a critical security role in both compliance and following best practices. This trend will only grow within various industries and throughout the overall data security environment.

Townsend Security offers Easy to Deploy, Cost Effective Two Factor Authentication Solution for the IBM i Platform

Alliance Two Factor Authentication brings mobile SMS and voice verification to the IBM i platform. The solution was built to solve large scale problems in a cost-effective manner and appropriately addresses the concerns raised in the various guidelines and standards listed above. Remote access to networks containing critical payment, patient information, or financial records can be protected with the Alliance 2FA solution using your mobile phone to receive authentication codes.

If you're struggling to understand encryption key management, trust me, you're not alone. If you are just beginning your research, here is the first step to lead you in the direction of a comprehensive key management plan that meets all data security compliance regulations.

If you're struggling to understand encryption key management, trust me, you're not alone. If you are just beginning your research, here is the first step to lead you in the direction of a comprehensive key management plan that meets all data security compliance regulations. In part one of

In part one of  Split Knowledge can also play a crucial role in protecting your data encryption keys. Parts of the security standard state that you shouldn’t export a key in the clear from the AKM database and that the key needs to be protected. For this to occur, you'd first have to have your Admin latch up to the key server utilizing a secure TLS connection with the proper credentials and authenticate to the server. Once the connection is established, the admin is free to export or import symmetric keys, however upon export they will be required to protect the symmetric key with a RSA key. No manual establishment of keys in the clear is supported. By default this is out of the box functionality; we ensure this requirement by setting a configuration option for PCI-DSS mode.

Split Knowledge can also play a crucial role in protecting your data encryption keys. Parts of the security standard state that you shouldn’t export a key in the clear from the AKM database and that the key needs to be protected. For this to occur, you'd first have to have your Admin latch up to the key server utilizing a secure TLS connection with the proper credentials and authenticate to the server. Once the connection is established, the admin is free to export or import symmetric keys, however upon export they will be required to protect the symmetric key with a RSA key. No manual establishment of keys in the clear is supported. By default this is out of the box functionality; we ensure this requirement by setting a configuration option for PCI-DSS mode.